Buying a home now or later is ultimately a personal decision. If you’re on the fence about your big purchase, we have put together a list of things for you to consider. Know what is going on in the real estate market and understand your finances to make an informed decision. It’s about how stable you think your income is during a recession instead of timing the market.

The top 5 things you should think about before buying a home during a recession:

1. Job Stability

Job stability is the number one on our list when it comes to buying a home even when it’s not a recession. If you think you may get laid off or you are in an industry that does not perform well during a recession, buying a home can be daunting and perhaps delayed.

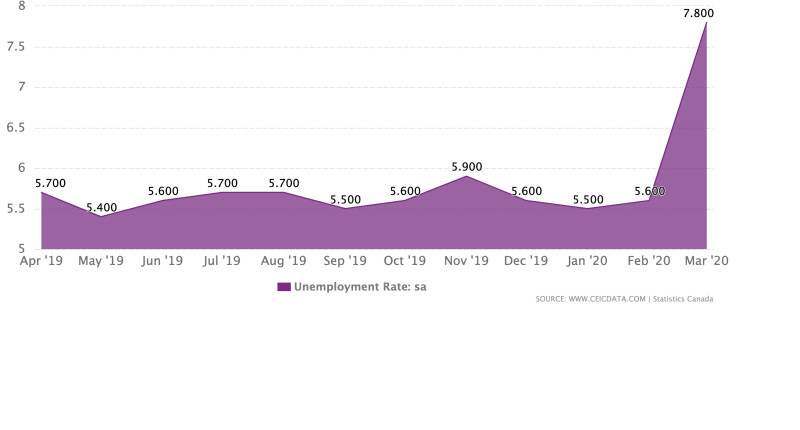

A graph on Canada’s unemployment rate in the last 12 months:

Canada’s unemployment rate has increased from 5.6% in February to 7.8% in March 2020. This means that Canada has lost over a million jobs in the past month due to layoffs because of COVID-19. Keep in mind that it only took about three weeks for COVID-19 to cause a spike in the unemployment rate and it does not include the impact that it continues to have moving forward as Canada continues to keep non-essential businesses close. Though the Government of Canada has implemented many measures to help Canadians pay for essential goods such as housing and food it means many Canadians are just scraping by especially in larger cities such as Toronto where the average monthly housing costs is $2,349.

As the unemployment rate continues to increase, only a few industries are able to escape devastating losses. On the other hand, many of the jobs lost will come back once the economy opens up as the situation with COVID-19 improves. This will lower the unemployment rate and provide more job stability for those affected. The reality is that things are uncertain and no one knows when things will return to normal. For the time being, we encourage everyone to be more cautious when it comes to buying a home because it’s a huge financial responsibility and banks will not lend you money for a mortgage if you lose your income before your home closes.

2. Risk and Volatility

You might be familiar with the concept of risk-reward, which states that the higher the risk of a particular investment, the higher the possible return. Real estate is considered a middle-risk investment, while housing generally offers a stable return it is still risker as outside factors can control the volatility of the market. In general, risk in real estate has not been discussed frequently in recent years because the overall Canadian housing market has enjoyed a lot of growth.

Many investors during these volatile times will purchase investment properties. If you are in a position where you are equipped with more cash, there are opportunities to look for bargain deals on properties, especially when the pool of buyers has significantly shrunk. It’s a good time to look for deals that other people are afraid of making. However, only do this if you are comfortable with volatility in the short run as prices have a much bigger chance of decreasing compared to just a few months earlier. You also need to be ready for not being able to liquidate your investment at a profit for a long time. Real estate is a long-term investment and if you need to use your capital elsewhere, it won’t be the right type of investment for you.

3. Credit Score

Your credit score is extremely important when you are getting pre-approved for a mortgage. There are different levels your score will fall under to determine if you will be approved for a mortgage or considered a high-risk borrower. You can check your credit score yourself before even applying for a mortgage and can help you prepare for your chances of being approved for a mortgage. Generally speaking, a credit score of 620 or above improves your chances of getting a loan significantly. A credit score of 500 or lower makes it very difficult to obtain a loan. Your chances of getting approved for a mortgage for buying a home will also depend on your current outstanding loans and employment status. Check here to see how credit scores are broken down.

4. The Time You Plan on Living in The Home

How long you plan on living in your home also matters in your real estate investment because there are closing costs associated with buying a home. With the high costs of homes and the low inventory, we are facing many homeowners are living in their homes longer than ever before. According to the National Association of Realtors, the median duration of homeownership in the U.S as of 2018 is 13 years which has increased by 3 years since 2008. If you are planning on buying a home making sure the home fits not only your current needs but your possible expected needs for the next 10 to 15 years will help ensure you do not “grow out” of your home too quickly.

About 25% of first-time buyers tend to live in their homes for 5 years or less. When the housing market is doing well, selling a home after living in it for only 5 years could be profitable after accounting for closing costs. However, if you believe that your local housing market could go for a downturn or stay flat, then it’s in your best interest to buy a property that you plan on living in for a longer time to avoid losing money when you sell.

5. Understand Past Recessions

What has happened to housing supply and prices during past recessions can help set your expectations on what may happen in the future. This is crucial when planning to buy a home. Typically during a recession, the inventory of homes on sale will increase and the prices of homes will decrease. This was especially true during the 2008 financial crisis in the U.S. Furthermore, during the U.S Great Recession, home prices fell approximately 33%. Though experts do not believe that the housing market will face the same challenges as previous recessions and depressions due to COVID-19, it’s important to be aware that economic downturns make housing unpredictable and all sorts of outcomes are possible. Governments have learned from the mistakes of the Great Recession and have contingency plans to keep the housing market stable.

Pros of buying a home now instead of later:

As a homebuyer, you may be able to get a better deal on a home by having greater negotiating power. Prices are likely to stay flat in the short term or even drop. In any case, they are unlikely to increase given the current economic situation is just starting to unfold. In addition, interest rates are at the lowest they have ever been. Being able to lock in a good rate now will help keep interest payments low. It’s a great time to get pre-approved even if you don’t plan on buying right away.

Cons of purchasing a home now when the economic outlook is uncertain:

Buying a home at any point is exciting and somewhat stressful even when the economy is good. There are certainly factors that could make you want to delay buying a home right now. Most importantly, job stability is at an all time low and you may not be able to get approved for a mortgage if you suddenly lose your income. Furthermore, there are less homes on the market which means that you will not have as much choice compared to normal markets. However, you can still keep an eye out in case the right home comes up. Lastly, with any investment, there are fears that home prices may drop due to the impact of COVID-19. If you plan on living in your home for a very long time, this should not be an issue.

Finally, how do you decide the right time on buying a house?

While there is no exact correct answer when the right time is to buy a house there are many factors that can help you decide if now is a good time. We advise you to be more cautious during this time given that the shutdowns that the COVID-19 pandemic have caused are unprecedented. If you are in good financial standing, have a 20% down payment, have your closings costs along with a 6-month contingency fund you should be able to buy a home and not have to worry about the effects on the economy during this pandemic. If you do plan on buying a home during this time here are 2 questions you need to ask yourself before meeting with a Mortgage Professional.

There is a lot of economic uncertainty but it doesn’t mean that your real estate goals have to be put on a pause. Talk to a real estate agent and discuss options with your financial advisor. You can always start planning and get advice from professionals before making your decision on purchasing a home.

For more information about the impact of COVID-19 on the real estate market, we have gathered a list of frequently asked questions that get updated as the situation changes. You can find the FAQs about COVID-19 and the real estate market here.

ABOUT US: Fivewalls empowers home buyers and sellers to find the best real estate agent for their families. We've done all the work for you by creating one secure site to meet and contact top real estate professionals from leading brokerages.

Disclaimer: given that the Coronavirus (COVID-19) has caused shocks to how real estate is operated, please note that the information above could change at any time given that companies are constantly updating their policies in response to the pandemic. Intended to Solicit Buyers or Sellers that are not currently under contract with another real estate brokerage.